In TriFact365 it is possible to work with VAT exempt. Additional settings are required.

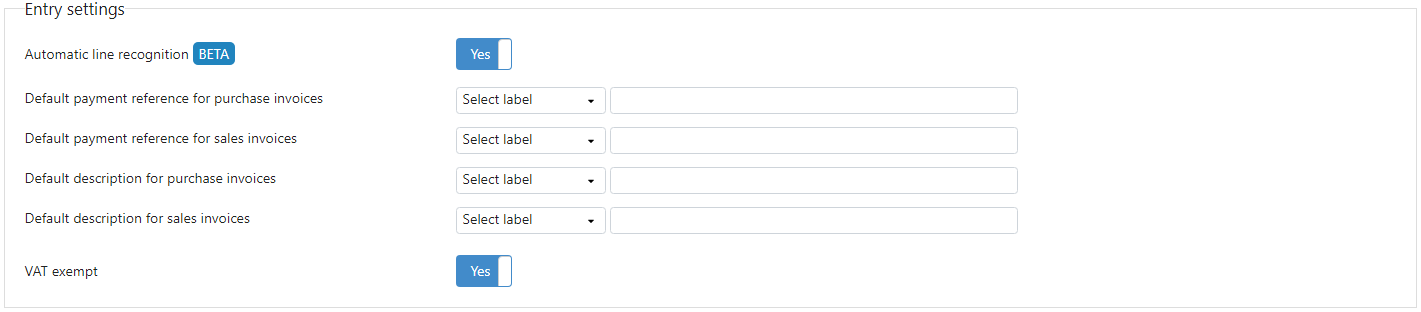

In TriFact365 go to Settings (Cogwheel) > Administrations > Three dots > Edit > Settings. Then set VAT exempt to Yes and click Save.

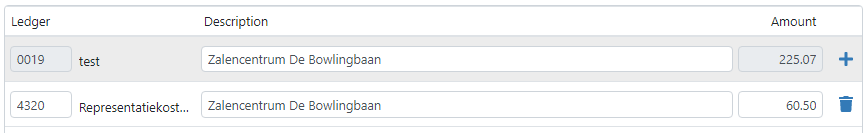

All journal entry proposals will then be presented with an Amount including VAT. In addition, the VAT code No VAT or None will be selected by default.

SnelStart

Note

In SnelStart, the ledger functions of the ledger accounts must support No VAT. Otherwise, the journal entry may still end up in SnelStart with VAT.

iMUIS Online, King Anywhere, King Business software and Visma eAccounting

Note

You must select a VAT code for purchase and sales invoices. This is then selected by default on the journal entry proposal.