Note

Additional settings in TriFact365 or the accounting software are required.

AccountView

- In AccountView go to Opties > Instellingen > Administratie > Financieel I.

- Make sure a ledger is selected for Transitoria debet and Transitoria credit.

- Want to spread the e journal entries over different financial years? Make sure the financial years are available in Account View.

When the settings are finished you are able to make an accrual entry.

AFAS

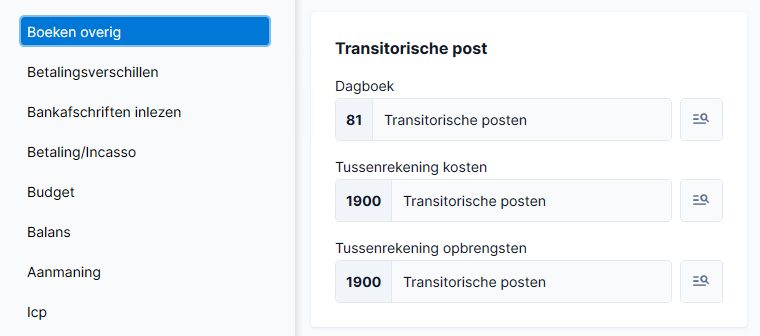

- In AFAS go to Financieel > Beheer > Instellingen administratie.

- Select the tab Boeken overig.

- Select a Dagboek and Tussenrekening at Transitorische post.

In AFAS go to Financieel > Beheer > Instellingen administratie. Select the tab Boeken overig. Select a Dagboek and Tussenrekening at Transitorische post.

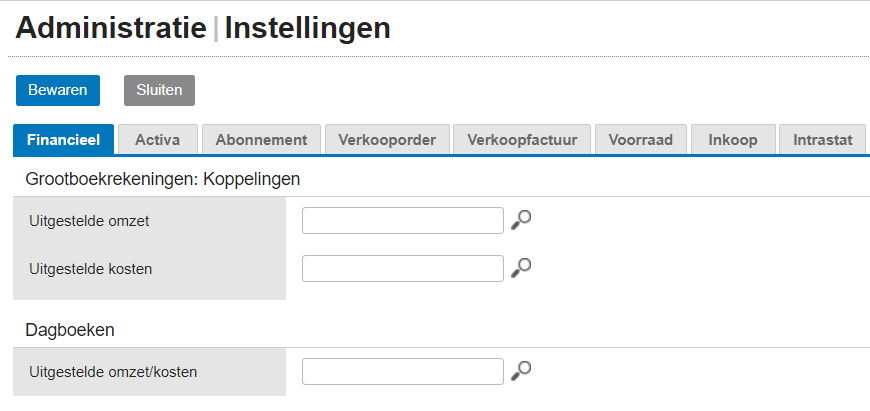

Exact Online

- In Exact Online go to the settings of the administration. Click on the tab Financieel and add a ledger to Uitgestelde omzet and Uitgestelde kosten.

- Connect a Memorial journal to the postponed costs/revenues. It’s advised to create new journals for this setting.

When the settings are finished you are able to make an accrual entry.

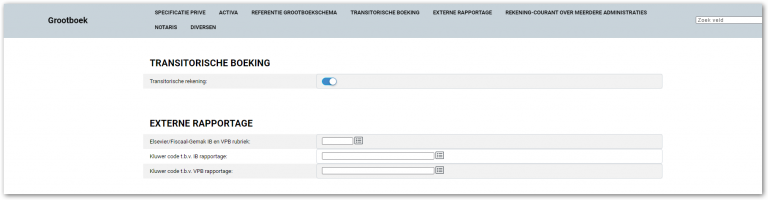

iMUIS Online

- In TriFact365 go to Settings > Administrations > Magnifying glass.

- Select at Accruals a journal and ledger for using for the accrual entries.

With making the accrual entry make sure the used ledger is marked as Transitorische rekening in iMUIS Online.

When the settings are finished you are able to make an accrual entry.

Twinfield

- In TriFact365 go to Settings > Administrations > Magnifying glass > Settings.

- Select a Ledger account at Accruals.

When the settings are finished you are able to make an accrual entry.

Settings TriFact365

Step 1

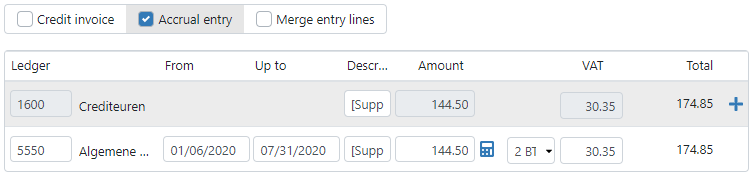

Check the box Accrual entry in the Check screen. Extra field will appear on the journal entry lines.

Step 2

Enter dates in the fields From and Up to to distribute the Amount and VAT for these periods.